The Federal Capital Territory Internal Revenue Service (FCT-IRS) has described the ongoing harmonisation drive in the FCT as a marathon rather than a sprint which will pave way for all concerns raised by stakeholders to be considered and addressed accordingly.

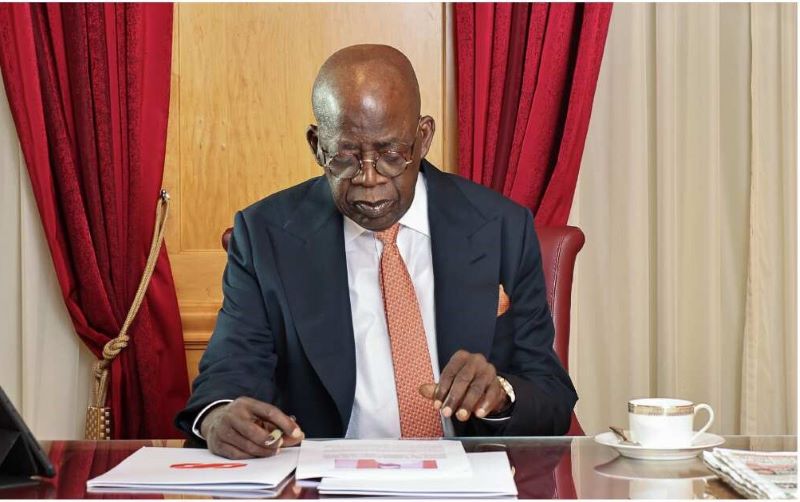

During the signing of the Memorandum of Understanding (MoU) on revenue harmonisation with Kuje Area Council in Abuja, recently the Executive Chairman of FCT-IRS, Mr. Haruna Abdullahi, clarified that as the project continues to take shape, stakeholders are encouraged to ask questions as the Service is committed to providing answers and to addressing concerns and fostering greater understanding.

According to him, the signed MoU between FCT-IRS and Kuje Area Council will provide stakeholders with a clear framework outlining their respective roles and shared responsibilities in this harmonisation initiative.

He said it would also serve as both a template and a beacon of hope, demonstrating the possibilities when organizations collaborate.

Abdullahi acknowledged that all concerns raised were valid, adding the FCT-IRS would actively engage with major stakeholders to provide clarity based on legal provisions.

Acknowledging the challenges ahead, Mr. Abdullahi expressed his confidence in overcoming them with determination, integrity, and a commitment to openness.

He assured the residents of the city that each and every contributed kobo would be properly accounted for and used judiciously as he reiterated the commitment of the Service to leveraging technology, strategic partnerships, and adopting international best practices to ensuring that the FCT-IRS maintains a high standard in its processes.

“This is not just about Kuje, it is a template and beckon of hope on what can be achieved when organisations come together. And I will also have to say here that all concerns are valid and that is why we are here.

“We’ll continue to engage major stakeholders and continue to clarify issues that are a bit concerning and clarify according to the law and every stakeholder has a reason to ask questions.

“This is new. I always say harmonisation is a marathon, so there will be challenges along the way but with determination and integrity that we have shown around the process there is honesty.

“So anybody that has concerns, the channels for clarifying these concerns are always opened and the service, does not know it all so we are also opened to guidance and clarification as well.

“As we embark on this harmonisation journey I want to assure all residents of the city that every contributed kobo will be accounted for and used judiciously.

“We’re leveraging technology, partnerships and international best practices and good practices to ensure that our processes remain top notch” he stated.

The FCT-IRS boss commended the FCTA Permanent Secretary,, Mr Adesola Olusade for his dedication and support throughout this journey adding that his unwavering commitment has been a source of hope and inspiration

Abdullahi also lauded the Executive Chairman of Kuje Area Council, Mr. Abdullahi Sabo, for his determination and steadfastness in supporting the Harmonisation process.

In his remarks, Mr. Sabo, affirmed Kuje Area Council’s confidence in the capacity of the FCT-IRS to handle revenue collection on their behalf.

He recalled that the area council had tasked the FCT-IRS with improving and standardizing their existing data, therefore all levy and revenue collections in Kuje area council would transit to an automated, cashless system.

The area council chairman expressed his commitment to the success of the project and indicated that other area councils would soon join in signing the MoU with the FCT-IRS to enhance and strengthen the overall harmonisation drive.

The FCTA Permanent Secretary, Mr. Adesola Olusade who witnessed the signing of the MoU, indicated that the journey towards harmonisation and ease of doing business began years ago, in 2012.

He acknowledged the challenges faced due to a lack of mutual trust and insufficient teamwork for implementation stating that with the recent developments, he was satisfied and fulfilled.

According to him, the harmonisation initiative will address issues related to multiple taxation and foster a more business-friendly environment in the city.

‘Today, I am fulfilled. The journey towards harmonisation and ease of doing business started as farq back as 2012. Efforts to conclude it had been very challenging because of lack of mutual trust and inadequate team work for the implementation.

“In 2012, we didn’t have FCT-IRS and the Service came to be as a creation of the law in 2015 and had to grable with tilting problems before it became eventually operational in 2018.

“Therefore, harmonizing revenue collection is not amounting to concession, the task before FCT-IRS is to collect the revenue on behalf of other revenue agencies and area councils and remit it to them in accountable and transparent manner” he explained.