While most Nigerian states are sinking deeper into debt, Edo State is rewriting the story—with action, not excuses.

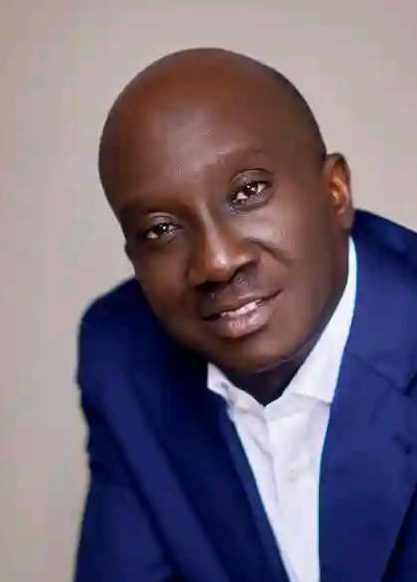

In just 90 days, Governor Monday Okpebholo has cut the state’s domestic debt by a whopping ₦30.6 billion, signaling a sharp turn from the borrowing binge that has plagued state governments nationwide.

Official data from the Debt Management Office (DMO) indicated that Edo’s debt dropped from ₦113 billion in Q4 2024 to ₦82.4 billion in Q1 2025—the biggest drop by any state in the country during that period.

What makes this more striking? At least 10 other states racked up ₦417.7 billion in fresh debts in the same quarter, despite enjoying higher FAAC allocations.

“We are not here to take shortcuts,” said Okpebholo. “We are here to fix Edo, grow the economy, and protect the future.”

Rather than borrow recklessly, the new government chose to plug leaks, tighten collections, and retool its revenue systems. The Edo Internal Revenue Service (EIRS) was revamped with digital infrastructure, real-time monitoring tools, and citizen outreach programs—all designed to widen the tax net and improve compliance without overburdening residents.

This aggressive reform has already paid off, boosting IGR and restoring public trust in the government’s ability to manage funds transparently.

And it’s not just about cutting debt—it’s about smarter spending. Under Okpebholo, the state now follows a value-for-money budgeting system that links funding to clear, measurable outcomes.

The focus? Roads. Schools. Healthcare. Power. Broadband. Not bloated bureaucracy.

Economist Dr. Nathaniel Igbinedion hailed the strategy as a “rare case of financial maturity” in today’s Nigeria.

“This is what subnational leadership should look like,” he said. “No PR stunts. Just solid reforms and responsible governance.”

The administration has also renegotiated loan terms and restructured repayments, bringing down the debt servicing burden and giving Edo fiscal breathing space.

Through it all—soaring inflation, subsidy removal, forex shocks—the Okpebholo team has remained steady, refusing to use national crises as an excuse for fiscal irresponsibility.

“Even in tough times, they’re making the right choices,” said