The United Bank for Africa Plc (UBA) may lose three of its branches in Abuja and other areas if it continues to defy a court order to release over N1 billion from Kogi State Government accounts to settle a judgment debt owed to former Deputy Governor, Elder Achuba Simon.

The National Industrial Court, Abuja, issued a garnishee order absolute on 27th November 2025, directing UBA to transfer N1,070,860,138, plus N2 million and N1 million in costs, from Kogi State Government accounts to Elder Achuba Simon’s Access Bank account.

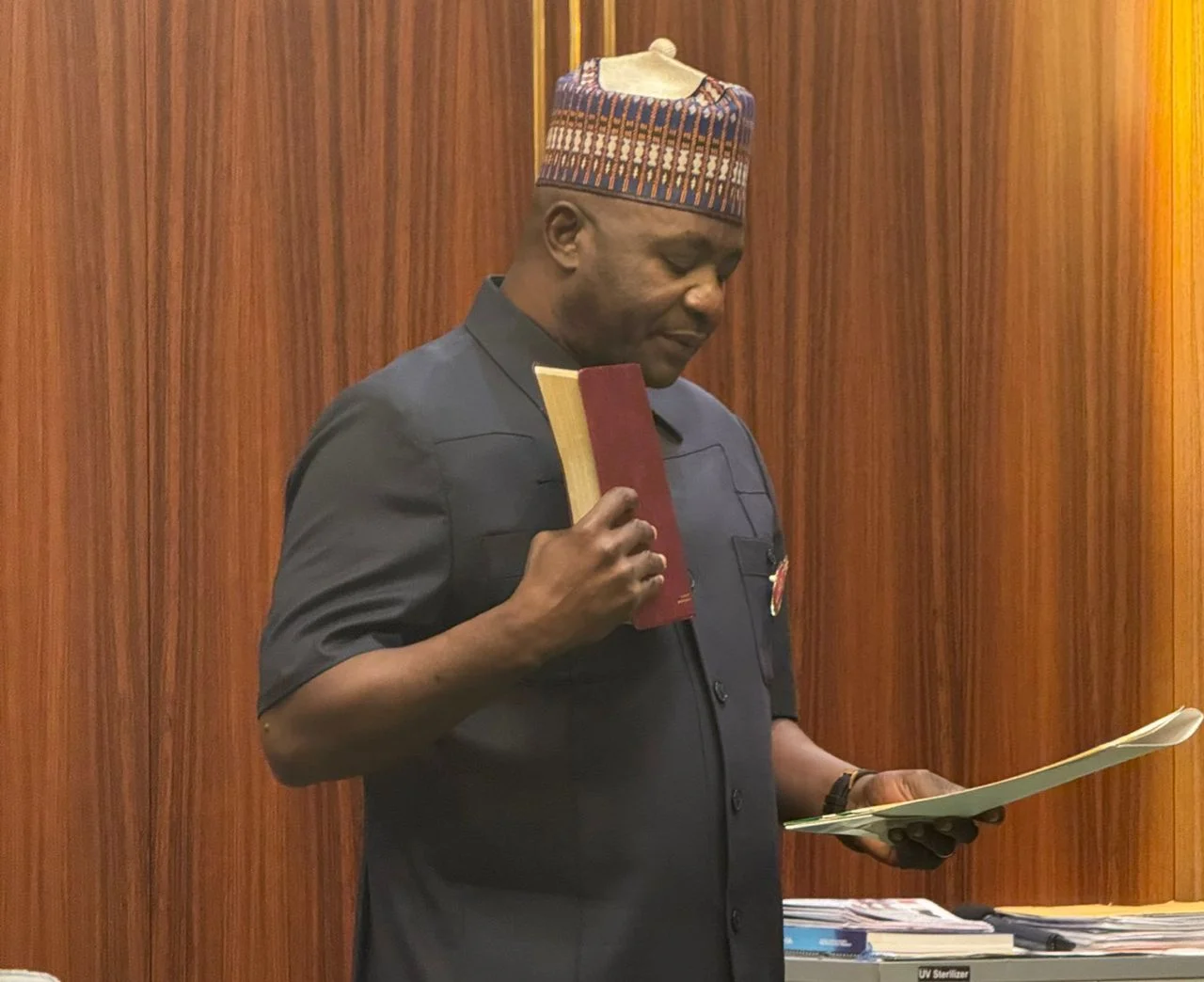

According to legal documents dated 22nd December 2025 and signed by Samuel Ogala of Falana & Falana Chambers, the bank has failed to comply despite multiple court rulings enforcing the judgment.

The debt traces back to a Court of Appeal ruling (CA/ABJ/PRE/ROA/1053M1/2024) confirming Elder Achuba Simon’s entitlement from Kogi State Government. An order nisi issued on 7th October 2025 required UBA to explain why the funds in the SRA account (N20,014,648.31) and the ACRESAL IDA Designated Dollar Account ($3,765,343.69) should not be released to satisfy the judgment. The court later made the order absolute.

Instead of executing the order, UBA filed an appeal and motion for stay of execution, which the court struck out on 18th December 2025. The judgment creditor’s lawyers have since issued a formal demand notice to the bank’s Chairman and CEO, warning that UBA is overstepping its role as a mere custodian of government funds and effectively acting on behalf of Kogi State Government.

The legal team also challenged UBA’s claim that the funds belong to the World Bank, citing the bank’s earlier acknowledgment that the accounts are in the name of Kogi State Government.

Under Nigerian law, garnishee proceedings allow creditors to access funds held by third parties for judgment debtors. Banks must comply unless they can prove a superior claim.

Falana & Falana cautioned that continued non-compliance could lead to further court sanctions, including attachment of UBA’s movable and immovable properties. A motion filed by Elder Achuba Simon seeking such attachment was heard on 18th December 2025, with the court adjourning the matter to 14th January 2026.

If the court grants the motion, UBA risks losing three branches along with other assets. Legal experts say the bank must act swiftly to avoid further legal, financial, and reputational consequences.

The matter highlights the strict enforcement powers of the courts in ensuring judgment debts are satisfied and reinforces the principle that banks cannot act as advocates for their clients in garnishee proceedings.

UBA Faces Possible Loss of Three Branches Over N1.07 Billion Judgment