***Lawmakers demand crackdown, accountability, justice after CBEX collapse wipes out life savings

The Nigerian Senate has declared an all-out war on Ponzi schemes and digital investment scams, following the catastrophic collapse of CBEX, a controversial investment platform that reportedly swindled Nigerians out of over N1.3 trillion.

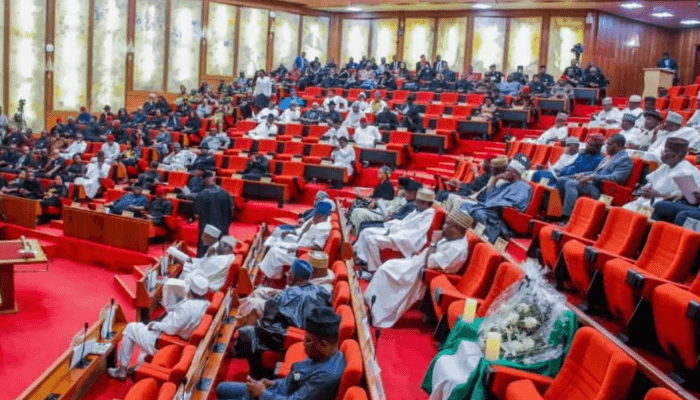

In a tense and emotionally charged session on Tuesday, lawmakers described the situation as a national crisis, comparing the unchecked rise of fraudulent schemes to an economic plague crippling the most vulnerable citizens.

“This is not just fraud—it’s economic terrorism,” thundered Senator Adetokunbo Abiru (Lagos East), who led the motion. “It’s sending people to their graves, wiping out entire life savings. The law must bite harder.”

The Senate unanimously adopted a motion mandating a comprehensive probe by a coalition of committees on Banking, Capital Markets, Anti-Corruption, ICT, and Cybersecurity. The joint committees are expected to report back in four weeks, after public hearings across Nigeria.

Lawmakers blamed both regulatory failure and public gullibility, citing years of weak oversight by the Central Bank of Nigeria (CBN), the Securities and Exchange Commission (SEC), EFCC, and NFIU.

“People are losing money, minds—and lives,” said Senator Sadiq Umar (Kwara North). “Our regulators are asleep while criminals walk away with trillions. If we do nothing, we are accomplices.”

Senator Solomon Adeola (Ogun West) warned that the scope of fraud has expanded beyond classic Ponzi schemes into fintech fraud, unregulated point-of-sale (POS) operators, and shady crypto platforms.

“The CBN must be summoned. What systems exist to vet these platforms? How are they even licensed? Why are people being robbed under the regulator’s nose?”

Senator Abdul Ningi (Bauchi Central) called the motion a historic moment, invoking Nigeria’s Constitution to remind colleagues that “the welfare of citizens is the first duty of government.”

“This has gone on for two decades. The laws are in place. So are the institutions. What’s missing is enforcement and will. This is our moment to act—or be remembered for doing nothing.”

One lawmaker recalled the 1990s Umana-Umana scam in Port Harcourt, where fraudsters stockpiled cash in warehouses that rats later devoured. Another painted a modern-day picture where students, pensioners, and small traders now fall prey to digital fraudsters promising miraculous returns.

“A criminal group can loot N1.8 trillion in plain sight—and no one is arrested? That must end now,” said Senator Muhammad Adamu Aliero (Kebbi Central). “If Nigerians are losing billions, why would any foreign investor trust us?”

The Senate resolution includes:

A nationwide public hearing campaign to educate citizens about the dangers of fraudulent investment schemes, a full investigative probe into CBEX and similar platforms, a performance audit of regulatory bodies such as CBN, SEC, EFCC, and NFIU and tougher legislation and oversight reforms to close existing loopholes.

Senate President Godswill Akpabio praised the motion and pledged full support,

“This is personal for every Nigerian. If you’re not a victim, someone close to you is. This chamber must stand with the people, speak the truth, and awaken the institutions built to protect them.”

With nearly ₦2 trillion lost, confidence shaken, and public outrage rising, the Senate’s move signals a turning point in Nigeria’s war on financial fraud. But whether this is the beginning of justice—or yet another promise lost to bureaucracy—remains to be seen.