The Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun has disclosed that Federal Government has taken bold steps towards reducing the N7.3 trillion Ways and Means it inherited with the

payment of the sum of N4.8 trillion.

He stated this on Tuesday in Abuja during the Ministerial Press Briefing on the achievements of his Ministry in the one year administration of the President as activities marking the celebration continues

He indicated that another N2.5 trillion will be paid in the second quarter of 2024

According to him, due to improved fiscal discipline, the Government has largely financed debt service obligations. including foreign debt service, without resort to Ways and Means Account

Such payments he added included outstanding commitments/shareholding to multilateral development banks

(MDBs) and international organizations, including over US$200m to Islamic Development Bank.

Wale Edun stated that on the National Single Window, the Federal Government launched the NSW, a technology platform for trade facilitation and import administration with the potential of annual economic benefit of US$2.7 billion.

He added that, the Presidential Fiscal Policy and Tax Reforms Committee (PFPTRC) is in the process of tax Harmonization and streamlining of tax collection processes which he said has come up with strategies for broadening tax net as well advanced in the single-digit tax system to reduce the number of taxes in the country,

Briefing on the Oil Revenue Increases, the Minister noted that Oil revenue of N1,1 trillion was achieved in the first quarter of 2024, as against N460 billion in the same period of the preceding year (2023),

Edun maintained that the oil revenue flowed from an impressive increase in oil production, which recorded 1.7mbpd in the first quarter of this year, up from 1.3mbpd in June 2023.

The Minister indicated that Federal Government revenues from GOEs also substantially

increased (Q1’2024 ₦835.7B vs ₦154.3B Q1’2023).

The impressive revenue record of the period under consideration was made possible by the introduction of technology-driven strategy systems to automatically deduct revenue due toFGN.

Similarly, he said the FGN has earned more FX income under the new revenue model.

“Specifically, the Nigeria Customs Service recorded unprecedented increases in the first quarter 87% Increase in 2023 revenue mobilization, as well as a 122% revenue increase in Q1 2024 compared to Q1 2023

In addition, he said that the Federal Inland Revenue recorded a 107% achievement of 2023 target and a 56% revenue improvement in Q1 2024 compared to Q1 2023.

Under the Fiscal Policies & Financial Management Edun said, the administration launched the Incentives Monitoring & Evaluation Platform (IMEP) to prevent the misuse of tax incentives by blocking and limiting access to those who do not qualify for the incentives.

“We also strengthened the implementation of fiscal policies around the Import Duty Tax Incentive to boost key economic sectors and deliver more sustainable socio-economic impacts.

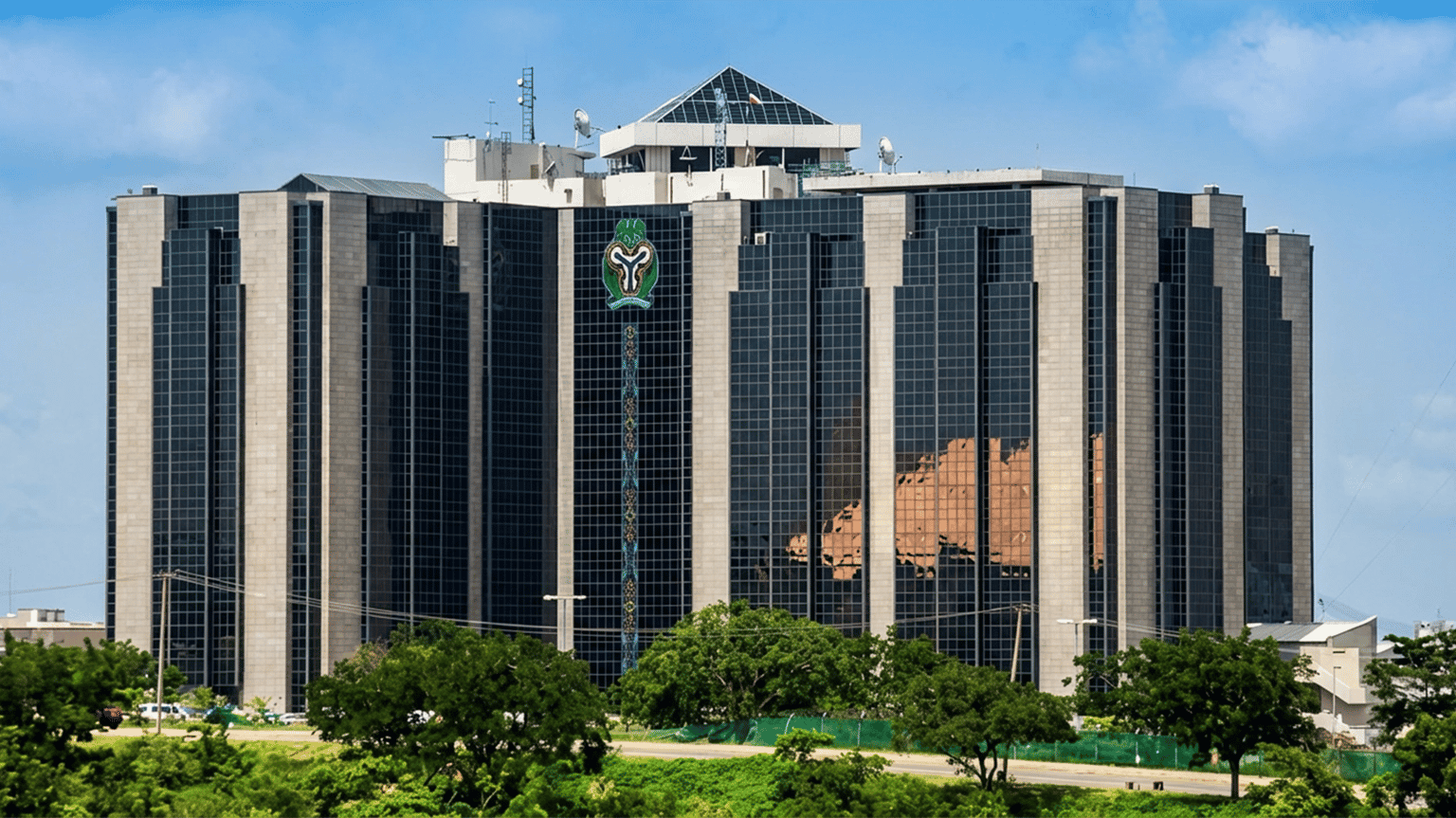

He disclosed that the FGN, via the Debt Management Office (“DMO”), raised ₦4.8 trillion from domestic capital markets to repay outstanding obligations to the Central Bank of Nigeria as it

works towards bringing the Ways and Means balance within legal limits and progressed to the final approval stages of a $2.25 billion single-digit interest loan from the World Bank for a 40-year-term with 10 years moratorium at 1% interest rate.

On Domestic USD Bond Issuance, the Minister revealed that the President has issued an executive order for local issuance of foreign-denominated securities. In a move that will showcase the resilience of Nigerian capital markets, the issuance of the first domestic foreign currency debt instrument is being processed by the capital marketfirms.

These bonds will be mainly marketed to both Nigerian and non-Nigerian investors with foreign exchange balances abroad* he said.

FDIs, MoF, under the leadership of Mr. President, he said, has actively engaged with a broad range of international investors from the Middle East, Europe and India to showcase the reformed economic policies of the FGN.

*It is anticipated that well advanced discussions with investors from the Middle East will yield positive results in the near term* Edun affirmed

He said that Infrastructure/Housing Finance Fund (MOFI) is partnering with Government Agencies and the private sector to boost investment in infrastructure, housing,

and to provide 25-year low interest rate mortgages.

“It is anticipated that long term funding from institutional investors will be mobilized via capital market funding”, he noted

While briefing on Improved Credit Rating, the Minister stated that over the last 12 months, two international credit rating agencies have reviewed Nigeria’s credit rating from ‘stable’ to ‘positive’ outlook.

Wale Edun, who was accompanied to the media briefing by the Permanent Secretary Federal Ministry of Finance Mrs Lydia Shehu Jafiya and the Permanent Secretary Special Duties, Federal Ministry of Finance, Mr Okokon Ekanem Udo,

Heads of Agencies under his supervision as well as Directors of the Ministry explained to the media on the issue of Coordination of Fiscal and Monetary Policies, that through the issuance of government debt securities by the DMO at higher interest rates, MoF has supported monetary policy authorities in attracting the inflow of foreign exchange from FPIs; and in stabilizing the exchange rate of the Naira.

New Monetary and Fiscal Coordination Committee was established.

He stated that on Financing of Major Infrastructure Projects,

MoF has provided from internal finances critical initial funding to kick-start major infrastructure projects such as the Lagos-Calabar Coastal Road.

In his closing remarks, the Honourable Minister of Information and National Orientation Mohammed Idris stated that the detailed presentation by the Honourable Minister of Finance and Co-ordinating Minister of the Economy Mr Wale Edun on the state of the Economy in year review has shown the commitment of the President Bola Ahmed Tinubu-led Administration in its avowed determination to ensure the general improvement in the lives of Nigerians and as such deserves our commendation.

He assured that Government will continue to formulate and implement policies, initiatives, programmes and projects that will impact positively on the lives of the citizenry in line with its Renewed Hope Agenda.