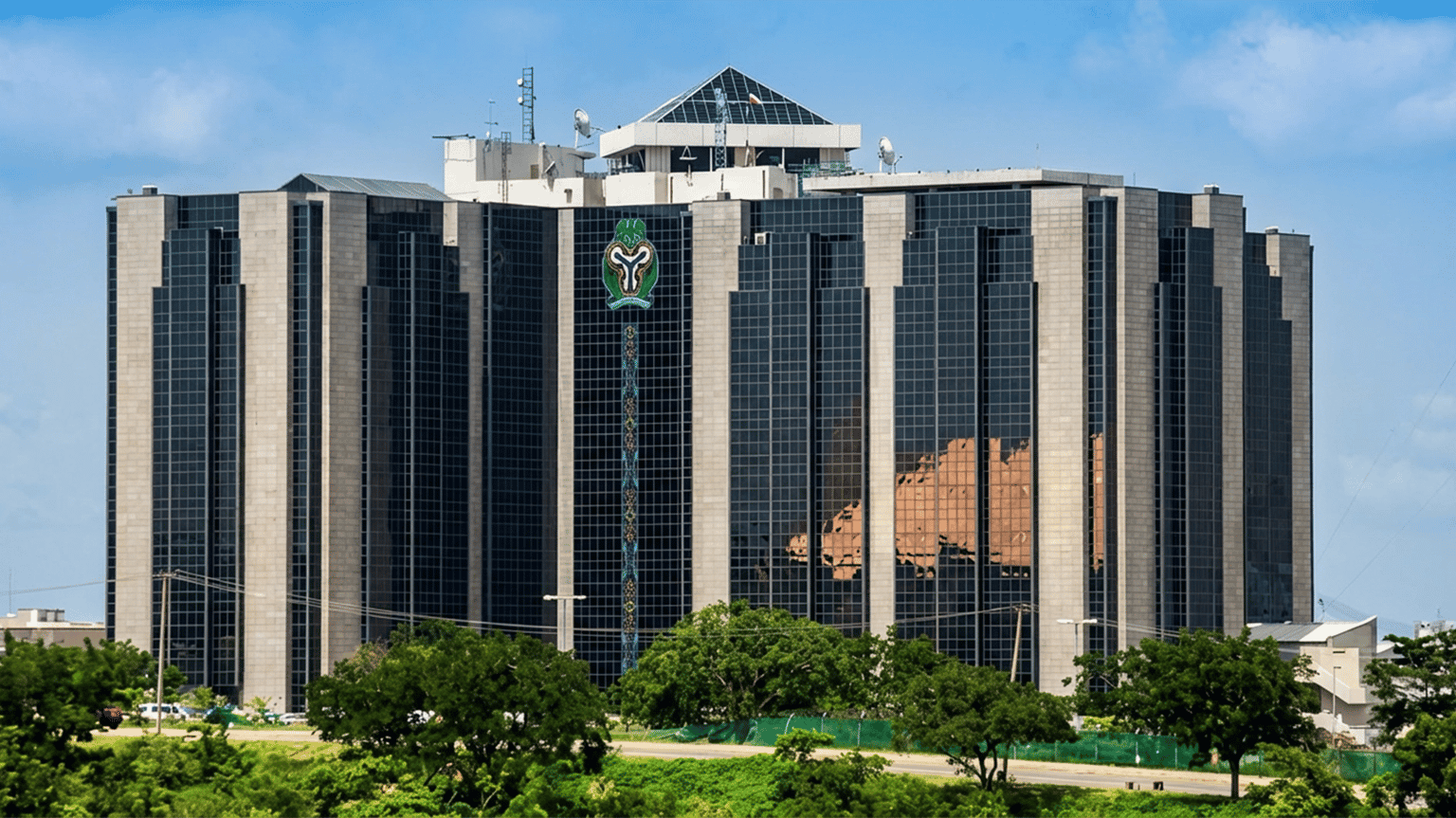

The Central Bank of Nigeria (CBN) has projected a steadier and more resilient economy in 2026, forecasting a growth rate of 4.49 per cent and a significant moderation in inflation, following sustained macroeconomic reforms and improved policy coordination.

In its 2026 Macroeconomic Outlook titled “Consolidating Macroeconomic Stability amid Global Uncertainty”, the apex bank said Nigeria’s economic outlook remains cautiously optimistic, despite persistent global risks, as inflationary pressures ease and foreign exchange stability improves.

The report noted that the economy is expected to stabilise further next year, supported by modest growth acceleration, stronger non-oil sector performance, and continued exchange rate stability. While structural constraints remain, the CBN said reforms implemented since 2023 have begun to yield tangible results.

The Bank disclosed that after an extended period of monetary tightening to curb inflation, it eased its policy stance in September 2025 to stimulate domestic investment and growth, citing sustained disinflation, improved liquidity conditions, and relative naira stability.

External buffers also strengthened in 2025, driven by higher remittance inflows through International Money Transfer Operators (IMTOs), steady oil revenues, and rising non-oil exports. These factors, the CBN said, supported exchange rate stability and reserve accumulation.

The Outlook highlighted “substantial progress” in Nigeria’s transition toward a full-fledged inflation-targeting regime, aided by improved forecasting tools, modelling frameworks, and enhanced policy communication. It also reported notable advances in the banking sector recapitalisation programme, with several banks already meeting new capital requirements.

According to the report, Nigeria’s economy grew an estimated 3.89 per cent in 2025, up from 3.38 per cent in 2024, supported by improved oil and non-oil sector performance. Inflation averaged 21.26 per cent in 2025, down from earlier highs, following tight monetary policy and better fiscal-monetary coordination.

Looking ahead, headline inflation is projected to decline sharply to an average of 12.94 per cent in 2026, aided by lower food and petrol prices, exchange rate stability, and sustained reforms.

The CBN said growth in 2026 would be driven by structural reforms, a gradually easing monetary stance, increased oil production, improved security, and expanded domestic refining capacity. The capital market is also expected to remain bullish, supported by bank recapitalisation and stronger investor confidence.

On fiscal matters, the Bank projected retained revenue and expenditure of ₦35.51 trillion and ₦47.64 trillion respectively in 2026, resulting in a provisional deficit of ₦12.14 trillion, equivalent to 3.01 per cent of GDP. Public debt is expected to rise moderately to 34.68 per cent of GDP by end-2026.

Externally, Nigeria’s current account surplus is forecast to increase to $18.81 billion in 2026, supported by stronger exports, steady remittance inflows, and higher oil and gas output. External reserves are projected to rise to $51.04 billion.

However, the CBN warned that risks remain, including possible inflation resurgence from excessive fiscal spending, global financial tightening, oil production disruptions, adverse weather conditions, and geopolitical tensions.

Deputy Governor, Economic Policy, Muhammad Sani Abdullahi, said the Bank remains committed to maintaining price stability while supporting sustainable growth through data-driven and timely policy interventions.

The report also called for deeper fiscal reforms, effective implementation of the Nigeria Tax Act 2025, and borrowing practices aligned with debt sustainability to preserve macroeconomic stability.

CBN Forecasts Stronger Growth, Easing Inflation in 2026