By Friday Idachaba, Lokoja

KOGI State Internal Revenue Service (KGIRS) has advocated adequate awareness and deepened public understanding of the nation’s Tax Acts 2025 to ensure smooth compliance as the laws becomes from January 1, 2026.

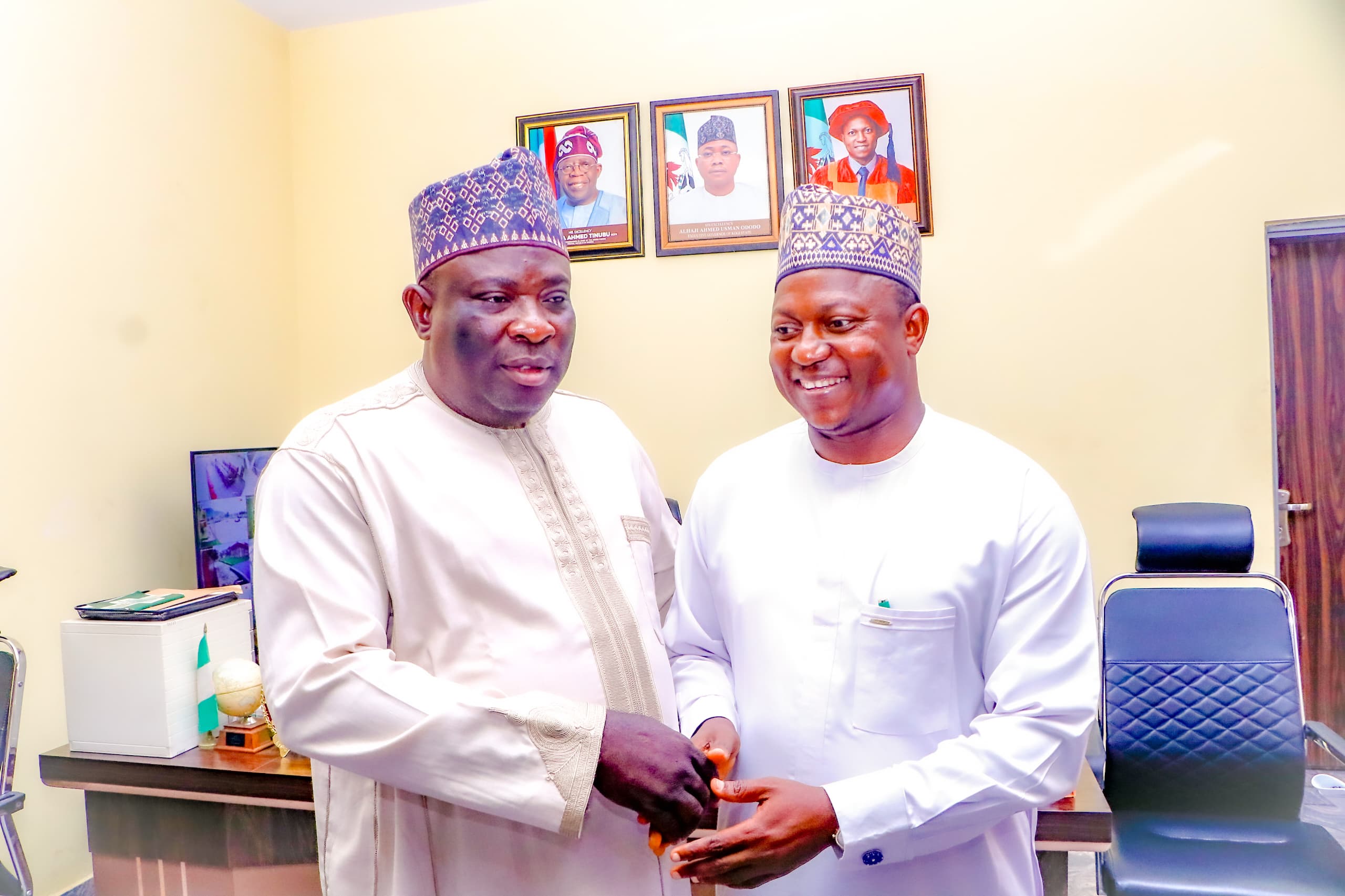

Alhaji Sule Salihu Enehe, Executive Chairman of KGIRS disclosed this at a one-day stakeholders forum on the Nigeria’s Tax Acts 2025 at the Glass House, Government House, Lokoja.

Enehe described the Tax Act, 2025, as a consolidation of over a dozen existing Federal Tax Laws alongside other regional laws, to enable operational efficiency, boost the economy, and pave way for development.

According to him, the new Tax Reform is aimed at enhancing revenue generation, simplifying compliance procedures, and addressing regional disparities in tax administration.

“The Stakeholders’ engagement is targeted at ensuring better understanding of the Nigeria Tax Act ahead of its full implementation from January next year.

“The reform package includes four principal acts namely; Nigeria Tax Act, Nigeria Tax Administration Act, Nigeria Revenue Service (Establishment) Act and Joint Revenue Board (Establishment) Act”, he stated.

In his goodwill message, the Special Adviser to Governor Ododo on Internal Revenue, Hon. Dr Rahman Nasir Ichanyi described the Stakeholders Forum on the Nigerian Tax Act, 2025, as a shared commitment towards building a more transparent, efficient, and citizen-friendly tax administration system.

The system, he said, is one that aligns with national reforms while addressing the unique socio-economic realities of our dear state adding that it depicts dedication to a stronger fiscal ecosystem where everyone plays a responsible role

According to him, the Nigeria Tax Act 2025, introduces major reforms aimed at widening the tax net, improving compliance, strengthening legal frameworks, and enhancing revenue generation for sustainable development without killing businesses and individuals.

He commend the leadership of the KGIRS for demonstrating innovation, professionalism, and proactive engagement in preparing Kogi State ahead of the full implementation of the Act.

“The future of our tax administration depends on our collective understanding of the law, our willingness to comply, and our commitment to integrity in revenue governance” he stressed.

In his presentation of the overview of the Tax Acts, Barr. Dele Suru outlined key structural changes introduced to modernize the nation’s tax system.

Another resource person, Mr. Emma Yusuf, spoke extensively on the major provisions of the Acts, stressing the importance of early preparation by taxpayers and institutions. (Ends)