***Reject Delay, Demand GMD’s Appearance as Hidden Profits, Dubious Figures Rattle Confidence

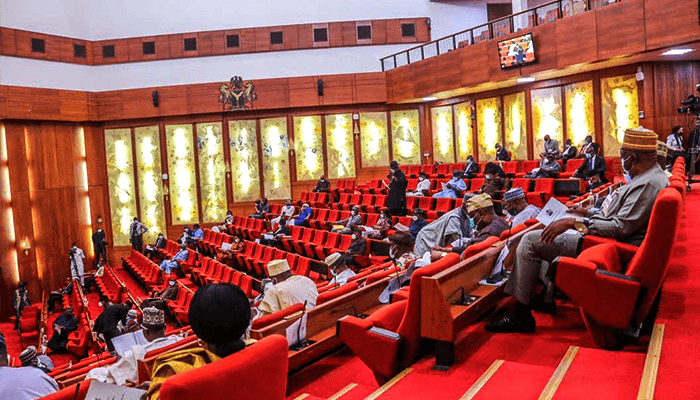

Nigeria’s oil behemoth, the Nigerian National Petroleum Company Limited (NNPCL), has come under intense fire as the Senate’s Public Accounts Committee issued a 10-working-day ultimatum for the company to explain more than ₦210 trillion in audit discrepancies—described by lawmakers as potentially the most alarming financial irregularities in the nation’s petroleum history.

The panel had issued 7 days grace for the NNPCL management and auditors to provide answers to 11 audit querries

The Senate’s fresh warning followed a heated session Thursday during which NNPCL requested a two-month postponement to respond to 11 unresolved audit queries.

In a letter dated June 24, NNPC requested the postponement, citing the need to “collate requested information and documentation” and the absence of board and senior management members.

But senators were unimpressed.

In a pointed rebuke, Committee Chairman Senator Aliyu Wadada (Nasarawa West) described the delay as unacceptable and indicative of either institutional unpreparedness or deliberate evasion.

In an emphatic address, he declared the request “unacceptable,” noting that the inquiry was not about fresh documentation but responses to questions already raised at a previous hearing.

“For a corporate body like NNPCL to ask for two months to respond to queries that originated from its own books is not only irresponsible but suspicious,” Wadada said. “This committee is giving NNPCL until July 10, 2025, to appear—with the Group Managing Director present in person—and respond to all outstanding issues. No excuses will be entertained.”

Failure to comply, the committee warned, would amount to contempt of the Senate and may trigger the invocation of constitutional powers to compel attendance and enforce accountability.

The lawmakers were quick to interpret the delay as a possible sign of unpreparedness or avoidance.

But the committee dismissed the explanation outright.

At stake is a sweeping investigation into NNPCL’s financial statements spanning 2017 to 2023, with allegations of undeclared profits, inconsistent audits, hidden liabilities, and massive unexplained expenses.

At the centre of the controversy is a curious financial dichotomy: while NAPIMS, a subsidiary under NNPCL, declared ₦9 trillion in profits over a five-year period, the parent company posted a ₦16 billion loss during the same timeframe.

Lawmakers have questioned why NAPIMS’ gains were never consolidated into NNPCL’s group accounts, branding it a “calculated deception.”

Wadada also raised alarm over NNPCL’s abrupt halt of separate audits for NAPIMS in 2022, demanding verifiable proof that all assets and liabilities were transferred appropriately.

The 2023 audit raised even deeper concerns:

₦103 trillion listed as accrued expenses without any supporting documentation;

₦107 trillion in receivables, also without evidence;

₦600 billion in contract retention fees lacking clear contractual details;

A suspicious ₦2.7 trillion foreign exchange loss, with no reconciliation;

Conflicting subsidy figures—₦3 trillion in one report and ₦5.1 trillion in another.

The committee grew even more alarmed when NNPCL submitted a last-minute document that directly contradicted its previously published audit, casting doubt over the company’s financial integrity and its much-publicised ambitions for a future Initial Public Offering (IPO).

The absence of NNPCL’s external auditors at the hearing further deepened lawmakers’ mistrust.

The committee has summoned them to appear, stating that silence in the face of growing financial irregularities would not be interpreted kindly.

Adding to the gravity of the situation, officials from Nigeria’s major anti-graft agencies—the Economic and Financial Crimes Commission (EFCC), Independent Corrupt Practices Commission (ICPC), Nigerian Financial Intelligence Unit (NFIU) and the Department of State Services (DSS)—were present at the session and directed to stay involved throughout the investigation.

Vice Chairman of the Committee Senator Peter Nwaebonyi, in frustration, remarked:

“This two-month delay request tells us one thing—NNPCL doesn’t have answers. But we will wait ten days. On July 10, the GMD must come. In person. And come clean.”

With public funds, investor confidence, and national accountability hanging in the balance, the July 10 hearing is now shaping up as a watershed moment—one that could define the transparency credentials of both NNPCL and the administration under which it operates.