***CIIN demands mandatory Insurance Policy for all buildings, vehicles

The move by the Senate to reform the Insurance sector as contained in a draft bill to that effect has recieved overwhelming support from the Attorney – General of the Federation and Minister of Justice, Prince Lateef Fagbemi ( SAN) and major stakeholders on Friday.

The endorsement of the Attorney General and the Insurance stakeholders for the bill came at a public hearing on the proposed legislation.

The public hearing for the Bill entitled, “Nigerian Insurance Industry Reform Bill, 2024” organised by the Senate Committee on Banking , Insurance and other Financial Institutions.

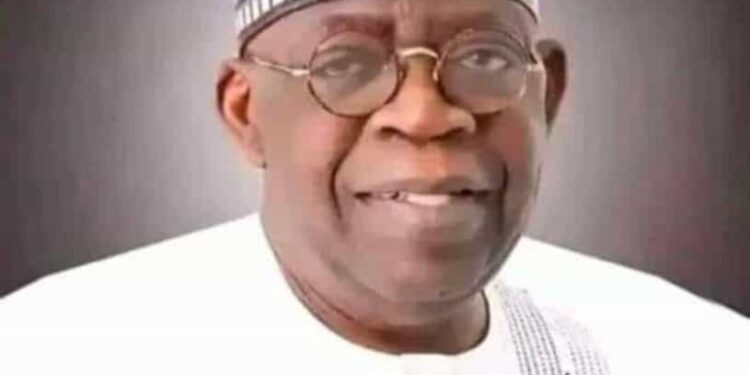

The bill was sponsored by Senator Adetokunbo Abiru ( APC Lagos East).

In his support for the bill the Attorney General, represented by one of his aides, Mr Oloyede Hussein, said the proposed reform, will help to curb capital flight that has been the order of the day in the Insurance sector in Nigeria.

“The office of Attorney – General of the Federation, has studied the proposed provisions contained in the bill with strong conviction that it would reform the sector from one plagued by capital flight, to economy contributory sector”, he said .

In the same vein, the Managing Director of NDIC, Bello Hassan, in his presentation at the Public Hearing said the proposed legislation is commendable and that the corporation is 100% behind the proposed reforms.

However, in her presentation, the President of Chattered Institute of Insurance of Nigeria, Mrs Yetunde Ilori, acknowledged the support of the Insurance reform bill.

On the other hand, She said the provisions that will make all motors in Nigeria to be insured by their owners, should be included as being practiced in most other countries of the world.

According to her, such provision, would deepen insurance penetration in Nigeria, make the sector more viable and make risks management more effective for the insured.

The President of Nigerian Council of Registered Insurance Brokers, Babatunde Adeleke, in his presentation, said the council supported the reform bill but wants inclusion of provision that would compel all officially approved houses in Nigeria to be insured.

“This is very necessary and requires empowerment of building approving authorities and National Insurance Commission (NAICOM), with relevant laws.

“For NAICOM, require legislation by way of provision in the reform bill, should be provided for it, to seal off buildings or houses that are not insured, “he said.

The Chairman of the Committee , Senator Adetokunbo Abiru, said members of the committee are happy that all the key players in the Insurance sector are in support of the reform bill and that suggestions and observations made, shall be looked into, before final report on the proposed legislation, is submitted to the Senate.