By Friday Idachaba, Lokoja.

Kogi State Internal Revenue Service (KG-IRS) has gone into partnership with exhibition managers, Built Environment and Building Materials Exhibition (BEBM) to educate and sensitize the populace on tax and rates payment in the state.

Chairman of BEBM Mr Oladipo Makakese Bayode, who disclosed this while speaking with newsmen on Sunday in Lokoja said that hiccups in tax payment had adversely affected the revenue profile of the state.

Bayode attributed the situation partly to lack of proper and efficient education and sensitization on payment of taxes and rates adding that it had consequently impeded development of the state.

He said the situation informed the partnership which is expected to guarantee generation of more revenue for the state to meet its service delivery to the citizens.

He said that the sensitization and education programme would feature prominently in this year’s exhibition.

The BEBM Chairman said that the partnership would also help guarantee proper organisation and coordination of building materials manufacturers, sellers and builders in the state.

This, he said, would further enhance construction of quality buildings and edifices across the state.

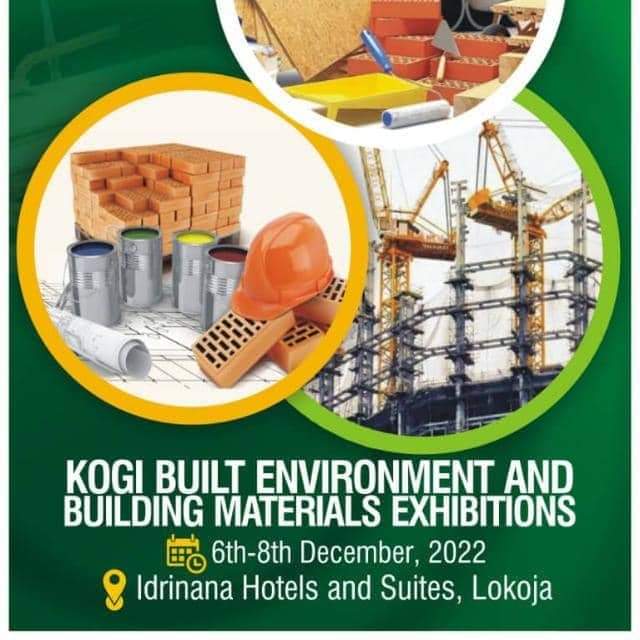

Bayode said the 2022 exhibition scheduled to hold at Idrinana Hotels and Suites, Lokoja on 7th December, is themed: “Taxes and Rates payment; A responsibility for development.”

He said that the keynote speakers would include Asiwaju Asiru Idris, the State Commissioner for Budget, Finance and Economic Planning; Hon. Sule Salihu Eneh, Acting Executive Chairman, KG-IRS and Prof. E. E. Lawal of the Faculty of Social Science, Federal University, Lokoja.

He promises the event to be highly educating would provide avenue for shared experiences by professionals.

He stated further that the BEBM is an annual event which debuted in 2016 has been able to expose manufacturers and builders to emerging ideas and trends to improve their services. (Ends)