The Federal Inland Revenue Service (FIRS) has indicated that its role is purely the collection of revenue for government and not keeping records of how the monies are

expended.

The service was responding to queries by the Special Adhoc Committee on Petroleum Subsidy Regime tasked to investigate petroleum products subsidy in Nigeria.

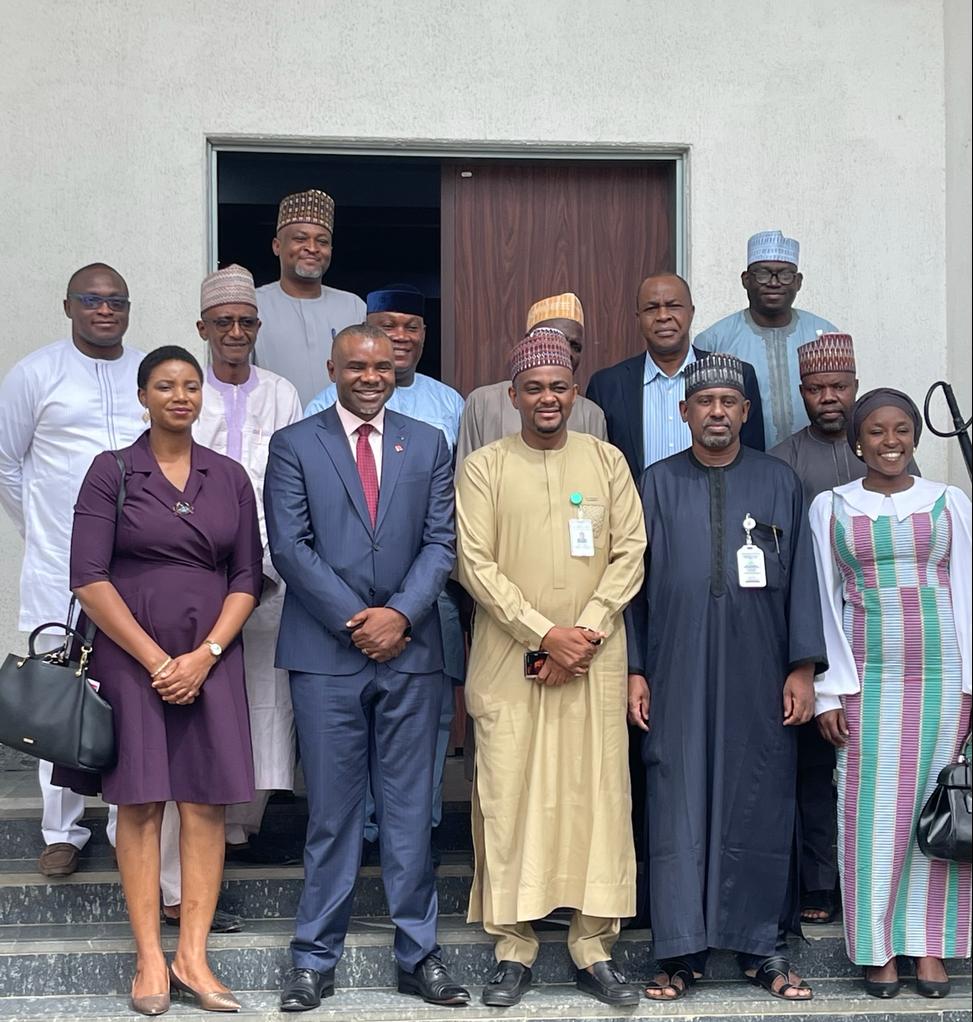

Speaking at the Committee sitting, the Executive Chairman, FIRS, Muhammad Nami, who was represented by the FIRS Coordinating Director, Compliance Support Group, Dr. Dick Irri, explained the role of the Service as provided by its Establishment Act was confined to the assessment of taxpayers, collection of taxes, accounting for and enforcement of taxes that were due to the government of the Federation.

“The Service’s statutory functions remains that of assessment, collection, accounting, and enforcement of payment of taxes that are due to the Government of the Federation and any of its agencies;” he explained, “Taxes collected by the FIRS are usually shared amongst the three tiers of the government in line with the constitution of the country; and FIRS does not maintain records of what the funds are used for by the three tiers of government. The Service also does not have the power to ask for such records.”

Explaining earlier, the Executive Chairman had stated that the request by the Committee for information on Subsidy payments and releases were not tax related, and thus were not within the statutory powers of the Service to respond to.

The Special Adhoc Committee had written to the FIRS requesting information on Subsidy Payment releases from the Consolidated Revenue Account, Subsidy claims, lodgment of FOREX into the Consolidated Revenue Account by the NNPC, among others.

“The Service holds the Adhoc Committee on Petroleum Products subsidy Regime and other Committees of the National Assembly in high esteem and will always give necessary support to ensure the success of their oversight functions;

“All the tax related information requested on your letter dated 1st July, 2022 has been duly submitted;

“All the 16 items listed on your letter dated 5th August 2022 are not tax related and also are not part of the responsibilities of the Service,” the FIRS Executive Chairman explained.

Apologising for his inability to appear in person, the Executive Chairman stated that his absence was due to other official national engagements outside the Federal Capital Territory.

The Special Ad-Hoc Committee on Petroleum Products Subsidy Regime, chaired by Hon. (Arc) Ibrahim Al-Mustpaha Aliyu was constituted in June 2022 with a mandate to investigate the Petroleum Products Subsidy Regime covering the periods from 2013-2021.