Senate

Senate Okays Tinubu’s controversial tax bills for second reading

The Senate on Thursday gave approval for the President Bola Tinubu’s controversial Tax Reform Bills to be read for the second time.

The Bills are: ‘A Bill for an Act to Establish the Joint Revenue Board, the Tax Appeal Tribunal and the Office of the Tax Ombudsman, for the harmonisation, coordination and settlement of disputes arising from revenue administration in Nigeria and for other related matters, 2024.

‘A Bill for an Act to Repeal the Federal Inland Revenue Service (Establishment) Act, No. 13, 2007 and enact the Nigeria Revenue Service (Establishment) Act to Establish the Nigeria Revenue Service, charged with powers of assessment, collection of, and accounting for revenue accruable to the Government of the Federation, and for related Matters, 2024.

‘A Bill for an Act to Provide for the assessment, collection of, and accounting for revenue accruing to the Federation, Federal, States and Local Government; prescribe the powers and funtions of tax authorities, and for related matters, 2024.

‘A Bill for an Act to Repeal certain Acts on taxation and consolidate the l;egal frameworks relating to taxation and enact the Nigeria Tax Act to provide for taxation of income, transactions and instruments, and for related matters.

The red chamber had earlier held a one- hour closed session where the federal lawmakers resolved to debate the general principles of the bills.

The Leader of the Senate, Opeyemi Bamidele, read the lead debate when the close session ended and the floor was open to the senators who wanted to contribute.

Opeyemi, while leading the debate on the general principles, indicated that the proposed legislation, if passed into law, will mark a paradigm shift in tax administration in Nigeria, to the advantage of Nigerians.

The senator representing Bayelsa West, Seriake Dickson, commended the executive for coming up with the landmark tax reform bills.

He said the fiscal legislation would entrench fiscal federalism in Nigeria if passed to law.

However, Senator Ali Ndume who is representing Borno South in the Senate, argued that the bills should be withdrawn for proper consultation in order to get the buy-in of the critical stakeholders who are opposed to it.

Ndume’s position was instantly countered by the Senate Chief Whip, Senator Tahir Monguno, who said the views of the stakeholders who are opposed to the bills could be taken at the public hearing after the legislation had passed.

President of the Senate, Godswill Akpabio, who presided over the plenary, put the question on whether the senators would want the bills pass or not and the lawmakers overwhelmingly voted in support.

Senate President, Godswill Akpabio after listening to Ndume, as well as presentations by Seriake Dickson and Mohammed Ali Monguno, who strongly supported the bills, passed them for second reading through voice vote.

The four reform bills’ passage for second reading by the Senate followed presentations made to that effect by the Senate Leader, Senator Opeyemi Bamidele (APC Ekiti Central), in general lead debate on them .

The Senate at the session accordingly passed the bills for second reading through voice votes.

Akpabio therefore mandated its committee on Finance , to organise Public hearing on the bill for inputs from those against the bills like the Governors’s forum, National Economic Council (NEC), Northern Elders ‘ Forum (NEF) etc and report back within six weeks

Senator Dickson, in his contribution during the debate voiced strong support for the initiative, emphasizing its alignment with fiscal federalism.

He acknowledged the concerns raised, particularly regarding the lack of extensive consultation with key stakeholders, including governors and traditional rulers, but maintained that the bills’ core objectives should be upheld.

Dickson underscored the importance of Nigeria’s governments at all levels relying on tax revenues, viewing this shift as essential for sustainable governance.

He commended the bills’ aim to encourage states to generate their own revenue by fostering investment and economic activity.

A major concern highlighted by Dickso was the derivation principle, especially in the context of oil-producing states. Dickson advocated for PAYE taxes of oil workers to be attributed to the states where they work, rather than where corporate offices are located, a move he described as long overdue and essential for equity in revenue allocation.

The senator supported the proposal to ensure VAT collected on goods and services consumed within a state be allocated to that state.

He emphasized that VAT is a consumption tax and should benefit the states where consumption occurs, whether in Bayelsa, Akwa Ibom, Sokoto, or Kano.

Dickson praised the provisions aimed at reducing corporate tax rates from 30% to 25% and exempting lower-income earners from PAYE taxes.

He highlighted the measures as significant steps in alleviating the tax burden on ordinary Nigerians, particularly those in vulnerable economic positions.

While supporting the bills, Dickson acknowledged the concerns of governors and other stakeholders regarding insufficient consultation. He expressed confidence that further dialogue would occur before the legislative process concludes and called for continued engagement to address outstanding issues.

As a self-declared federalist, Dickson emphasized that the proposed reforms align with the principles of fiscal federalism, aiming to empower states and reduce dependence on federal allocations.

He urged his colleagues to pass the bills for a second reading, enabling further scrutiny and public input during the committee stage.

In his speech, Senator Ali Ndume raised concerns about the proposed tax reform bills, emphasizing the need for broader consensus and questioning the timing of their introduction.

While supportive of reform in principle, he highlighted critical issues related to derivation, VAT, and the impact on small and medium enterprises (SMEs).

Senator Ndume expressed concern about the timing, suggesting that introducing tax reforms in the current climate could be misconstrued by the public.

He urged the Senate to consider the sensitivities of the moment, advocating for a more strategic approach to avoid backlash.

Ndume echoed calls for the bills to be withdrawn temporarily to allow for more consultation with state governors, the National Economic Council (NEC), and traditional rulers.

He emphasized that the reforms would be more effective if they had the buy-in of these critical stakeholders, suggesting that swift passage could occur after such consultations.

He identified derivation and VAT as contentious issues arguing that without constitutional amendments, implementing some of the proposals would be problematic.

He supported Senator Seriake Dickson’s point on revenue derivation but stressed the need for clarity and negotiation before passing the bills.

Ndume criticized the provision that applies the same reduced corporate tax rate (25%) to companies with annual turnovers ranging from ₦50 million to billions.

He argued that SMEs, such as those in Nnewi producing goods like shoes, should not be taxed at the same rate as large corporations, as this places an undue burden on smaller businesses.

He warned that reducing VAT for lower-income groups while increasing the corporate tax burden could have unintended consequences. Specifically, he noted that manufacturers might pass increased costs onto consumers, negating the intended benefits of the reform.

Senator Ndume concluded by urging the Senate to consider withdrawing the bills, making necessary amendments based on input from key stakeholders, and reintroducing them for swift passage.

In his contribution to the debate on the proposed tax reform bills, Senator Munguno highlighted the importance of adhering to the established legislative process and expressed strong support for the bills’ general principles, particularly those aimed at reducing the tax burden on Nigerians.

Senator Munguno disagreed with the suggestion by Senator Ali Ndume to withdraw the bills for further consultation with the Nigerian Governors Forum and traditional rulers.

He emphasized that the Nigerian Constitution, particularly Section 60, grants the National Assembly the authority to regulate its proceedings. According to Munguno, the legislative process is clear: after the second reading, the bills are referred to committee for public hearing, where all stakeholders, including governors and traditional rulers, are free to present their views.

He described the suggestion to withdraw the bills as an “academic exercise” outside the established legislative framework.

He stressed that the public hearing phase is the appropriate platform for stakeholders to voice their opinions on the bills. Governors, traditional rulers, and Nigerians from all walks of life are encouraged to participate at this stage to ensure comprehensive consideration of all perspectives.

Senator Munguno praised the bills for their provisions aimed at easing the tax burden on ordinary Nigerians.

He noted key exemptions, including VAT exemptions on essential goods and services such as food, medicine, education, pharmaceuticals, and electricity.

He commended the bill’s focus on protecting low-income earners by exempting those earning below the minimum wage from the Pay As You Earn (PAYE) tax.

Munguno supported the reduction of corporate income tax from 30% to 25%, arguing that it would incentivize companies to hire more Nigerians, thus boosting employment and economic activity.

He viewed this as a significant benefit that would help stimulate the economy while maintaining fairness in the tax system.

Senate President Godswill Akpabio provided insightful commentary on the challenges posed by Nigeria’s current tax system, particularly emphasizing the burden caused by the multiplicity of taxes imposed by various local governments.

His remarks were centered on the need for comprehensive tax reform that would streamline tax collection and reduce the harassment faced by citizens, especially travelers.

Akpabio highlighted a pressing issue faced by travelers in Nigeria constant demands for taxes by different local governments during interstate travel.

He painted a vivid picture of how travelers are stopped repeatedly by tax collectors demanding various permits, such as tire permits and exhaust permits, from different local governments. He cited examples of being taxed by local authorities in states like Edo, Anambra, and Abia, which often leads to long delays and financial extortion. He described this as a major obstacle to free movement and economic activity.

Akpabio called for reforms to address the multiplicity of taxes, which he noted creates fear and discourages travel and business across state lines.

He suggested that any effective tax reform should streamline these processes and eliminate redundant or overlapping tax demands, making it easier for citizens to comply with tax obligations without undue stress or financial strain.

He reminded his colleagues that the discussion was still on the general principles of the bills, with the specifics to be addressed during the public hearing.

Akpabio reassured that the Senate would consult widely, involving experts, traditional institutions, governors, and other stakeholders, to ensure that the final legislation serves the best interests of Nigerians.

Akpabio urged his colleagues to allow the bills to proceed to the second reading. He emphasized the importance of moving forward so that the bills could be thoroughly reviewed, debated, and improved during the public hearing stage.

He stressed that the Senate’s ultimate goal is to pass legislation that benefits all Nigerians.

Senator Akpabio’s remarks underscored the urgency of addressing the chaotic tax environment in Nigeria, particularly the harassment caused by multiple local government taxes.

Senate

Senate Bids Farewell to Governor Okpebholo, Declares Seat Vacant

***Lawmakers Praise His Leadership and Dedication, Wish Him Success in Edo

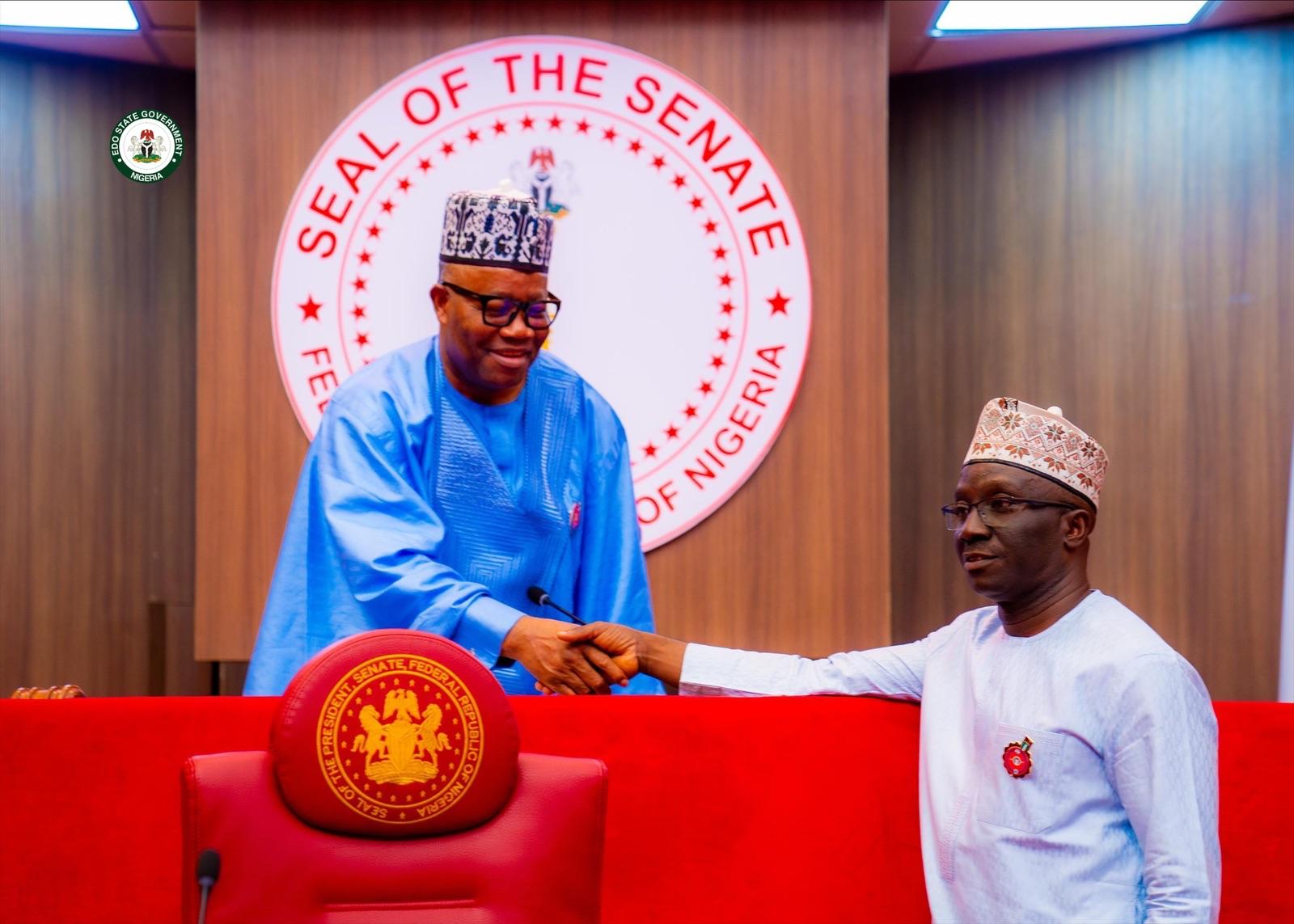

The Senate on Wednesday held a special valedictory session in honor of Governor Monday Okpebholo of Edo State, following his election as governor.

The session, presided over by Senate President Godswill Akpabio, was attended by nearly all senators, who celebrated Okpebholo’s tenure and expressed mixed emotions about his departure from the Senate.

Lawmakers commended Okpebholo for his humility, hard work, and commitment to serving his constituents. They praised him for his dedication to his work and his people, acknowledging his positive impact on the Senate during his time as a lawmaker.

Deputy Senate President Senator Barau Jibrin described Okpebholo as a man of action, noting that his election as governor was a reflection of his genuine concern for the welfare of the people of Edo State.

He encouraged the governor to remain focused on his duties and continue to serve with integrity.

Senator Adams Oshiomhole also lauded Okpebholo’s leadership, highlighting his rapid rise from senator to governor.

Oshiomhole noted that within 30 days of becoming governor, it was clear to the people of Edo State that a new and dedicated leader had emerged.

Senator Danjuma Goje praised Okpebholo’s commitment to his principles and his ability to follow through on his promises. He urged him to remain determined and resolute in his new role as governor.

Senate President Godswill Akpabio acknowledged Okpebholo’s achievements, particularly his leadership as Chairman of the Committee on Public Procurement, and encouraged him to carry forward his legacy of service in Edo State.

In his valedictory speech, Governor Okpebholo thanked the Senate for its support and expressed gratitude to his colleagues for their kind words. He promised to be a good ambassador for the Senate in his new role as governor.

“I am deeply grateful for the encouragement I received from Senate President Godswill Akpabio and my colleagues. Your support has been invaluable throughout my journey,” Okpebholo said.

He also expressed his appreciation to Senators Barau Jibrin, Opeyemi Bamidele, and other colleagues for their advice and support during his tenure.

Governor Okpebholo’s Senate seat was officially declared vacant, marking the end of his legislative career as he embarks on his new responsibilities in Edo State.

Senate

Discordant tunes from the senate over Controversial Tax Reform Bills

***As it refutes Reports of suspending actions

***Akpabio Defends Tax Reform Process, Dismisses Claims of Rushed Legislation

There were some disagreement at Plenary on Thursday when the Senate contradicted itself over its Wednesday proceedings on the controversial Tax Reforms Bills.

The Senate leader, Opeyemi Bamidele disagreed with reports suggesting that actions on the controversial Tax Reform bills have been suspended.

This was coming against the backdrop that at Wednesday’s plenary Deputy President of the Senate, Barau Jibrin while presiding had explained reasons for putting actions on hold on the bills.

Coming under Order 42, the Senate leader countered media reports suggesting that the Senate had suspended or withdrawn the tax reform bills, Bamidele issued a firm position that the tax reform bills remain active and under legislative consideration.

He emphasized that the bills, being executive in nature, can only be withdrawn by the executive branch itself.

“We just passed our votes and proceedings which is a reflection of our deliberations of the previous legislative day being yesterday, nowhere in our votes and proceedings was it stated that we suspended further deliberations on the tax reform bills because we did not and I felt it would be important to place on record senate did not suspend or withdraw.

“This senate did not suspend and does not intend to suspend deliberations consideration of the tax reform bills.

This is simply my response it was a misunderstanding of legislative process for anybody to have even reported that we had withdrawn the bills the bills were executive bills transmitted to us by the executive arm of government through the office of the president, it’s only the executive arm that can withdraw these bills they are not private member bills sponsored by any senator so no senator is going to withdraw the bill and there’s no reason for these bills to be withdrawn.

“In the legislative process it is normal that some people will have concern it is normal that people will sit around those concerns and discourse that is why in its wisdom this senate in referring this matter to the senate committee on finance gave them as much as six weeks.

“Our instruction was that, deliberate publicly and submit your report not later than six weeks. It might not be up to six weeks, but if they choose to be up to six weeks, nobody will quarrel with them.

“Six weeks is long enough in a country that wants progress for a consensus to be reached, for anybody who has concern to sit down and allow such concern to be addressed in overriding public interest. “In any case, Mr. President and distinguished colleagues, we are continuing with the deliberation, with the consideration of these bills.

“This is all I expected the media to report yesterday, which was well reported by some sections of the media, was that the Senate at its plenary session yesterday took a further legislative action in the consideration of the bill. “What was the further legislative action that we took? From northwest of Ademo Aleros, through the north central of Abba Moros, to the southeast of Oji Uzor Kalus, we drew out people, distinguished senators, from each. geopolitical zone and we constituted them into an Ad Hoc Committee to, on our behalf, further interface.

“We were clear about what we were doing. The Senate Committee on Finance is in charge of public hearing. But we set up an Ad Hoc Committee as a further legislative action to, on our behalf, interface.

“Even the President of the country, I mean, called on us to please interface with the Office of the Attorney General and Minister of Justice, which also we would have done in our public hearing. But even then, I mean, the executive requested for that.

“We have set up an Ad Hoc Committee to do that. So while the Finance Committee is working on its timeline, planning for the public hearing, we want this committee to also quickly engage.

“The Deputy Senate President yesterday, in announcing this committee on your behalf, also said, the Ad Hoc Committee should treat this matter with urgency, with this power, and that the meeting should start from today.

“As a matter of fact, Mr. President, the meeting started yesterday. So the essence of what I am saying is that it’s important that members of public are patient with us. They understand the legislative process that we have to follow.

“They understand our role in the Constitution. Any attempt from any quarter, to intimidate the Parliament, will be undemocratic, and will not allow ourselves to be distracted. But we will encourage consensus. We will encourage discussions, engagement at all levels.

“But we will not, we cannot be bullied into adopting a certain procedure. As far as we are concerned, the tax reform bills are allied. in this hallowed chamber they are receiving consideration at various levels and we are opened to discussions to negotiations to interface but let it not be said anywhere that we suspended further consideration of these bills and also it will be laughable for anybody to also think or say or report that the bills were withdrawn because like I said there are executive bills.

Responding the senate President said, “You came under Order 42 and also the constitutional provisions and the constitution is the ground norm. We can’t argue with the constitution. And Order 42 says that we should not engage in debates. And we should not also bring about any controversial matter.

“From your explanation, it would appear the Television station was totally misled into thinking that the bills were suspended or withdrawn by the Senate.

“Because I watched that news when the governor of Nassarawa was asked, now that the bills have been withdrawn, are you happy?

“The National Assembly, we were all elected to do our work. And that is the work of lawmaking in the overall interest of Nigeria. We do not do our work through social media. Neither do we do it through any committee or congregation of the church or any forum of any nature.

“We do our work according to our conscience in the best interest of Nigeria. And the processes of lawmaking.

“The mechanism of lawmaking can be further explained to the public. The moment the bills went through second reading in the Senate, it simply means that the bills are alive.

“The next procedure is for the committee on finance to commence the process of consultations and public hearings with a view to bringing recommendations back to the chamber.

“But in the wisdom of the Senate yesterday, we had, in a closed session, set up a committee to be headed by the minority leader before the passage of the second reading and we said, in the event that some people are either uneducated on some aspects of the bill or confused or there are gray areas to be sorted out, they should interface with the necessary executive quarters, from the chairman of Federal Inland Revenue Service to the Attorney General of the Federation, and if need be, even Mr. President.

“That committee was an internal mechanism of the Senate, different from the committee on finance. And I think that was what was announced yesterday, that that committee should immediately move into work. They should move into action.

Akpabio also refuted claims that the government was rushing the tax reform process, emphasizing that the legislative process is proceeding according to plan and in full alignment with established procedures.

Akpabio reassured Nigerians that there is “nothing sinister” behind the timeline, stating that the Senate has allocated six weeks for committee review. If necessary, the timeline will be extended to ensure thorough deliberation.

“This is executive communication in line with legislative procedure,” Akpabio explained. “The government welcomes meaningful input to address any gray areas in the bill, and President Bola Tinubu has already directed relevant ministries and agencies to collaborate closely with the National Assembly to ensure all concerns are addressed before the bills are finalized.”

Akpabio also highlighted that the Senate had proactively set up an Ad Hoc Committee before even receiving the President’s directive, reflecting the Senate’s foresight and commitment to transparency.

He assured stakeholders, including governors, religious leaders, and business figures, that they would have the opportunity to raise concerns publicly through the appropriate channels.

The Senate president further affirmed that the Senate would not be swayed by external pressure and would continue working in the best interests of Nigeria. “We are doing our work for Nigeria, and our final position will reflect the yearnings and aspirations of Nigerians,” Akpabio said.

In defending the tax reform bills, Akpabio emphasized that provisions like exempting businesses earning under ₦50 million from taxes and addressing the issue of multiple taxes would greatly benefit Nigerians. He also noted that the reform would exempt those earning less than minimum wage from paying taxes, benefiting up to 100 million Nigerians.

Concluding his remarks, Akpabio urged Nigerians not to be influenced by social media or certain media outlets, such as Arise Television, which had raised concerns about the process. He reiterated the Senate’s commitment to a fair and thorough process that prioritizes the public interest and supports the nation’s economic progress.

Senator Barau however at Plenary on Wednesday had announced that, “The Senate of the Federal Republic, as known by everyone and indeed other Senates in the entire world, are known to be the stabilisers of every country. “When there are difficulties and disagreements, the Senate of this country comes in with solutions through dialogue and consensus at all times to solve such problems, and the Senate of the Federal Republic of Nigeria has been doing that since 1999.

“Because of this, we decided to put politics, ethnicity, and regionalism aside to sit among ourselves and find the way forward with respect to the issues surrounding the tax reform bills.

“It is on this note that we extended our view to the executive arm of government and it was agreed that there should be a forum to sit down to look at the areas that are creating disagreements to resolve them so that the entire country will remain united – united in our effort to solve our problems.

“Before the introduction of these bills, we know we’ve been faced with several problems and insecurity that we’ve been trying to solve. The president has been trying, and we’re also working with him to solve issues about our economy, which is in line with global economic problems.

“We also agree that we shouldn’t allow anything else to aggravate our country’s problems.

‘It is on this note that it has been agreed by the executive and also by us that there should be a forum that will sit with the Attorney General of the Federation so that we can sit down and sort out all these problems in the interest of this nation.

“It is therefore proposed that by tomorrow (Thursday) there will be a meeting with the committee that we’ve set up here and the leadership to sit with the Attorney General of the Federation to look at those issues and resolve them.

“It’s on this note that the committee on finance that the bills have been referred to, should put on hold further action on it – public hearing and other issues until we resolve these issues.

“All sides will be given the opportunity and we shall resolve the issues before anything is allowed to go. “

Senate

Senate suspends Action on Controversial Tax Reform Bills

***Constitutes Special Committee to Engage FG

The Senate has suspended further action on the contentious Tax Reform Bills, as a result of widespread public outcry and opposition from Northern Governors, who labeled the bills as “anti-democratic.”

The decision was announced by Deputy Senate President Jibrin Barau during Wednesday’s plenary.

Barau explained that the Senate Committee on Finance had been directed to halt public hearings and deliberations on the bills until the concerns raised by various stakeholders are addressed.

A special committee has also been constituted to liaise with the executive branch to resolve the contentious issues.

The Contentious Bills Under Review are: ‘A Bill for an Act to Establish the Joint Revenue Board, the Tax Appeal Tribunal and the Office of the Tax Ombudsman, for the harmonisation, coordination and settlement of disputes arising from revenue administration in Nigeria and for other related matters, 2024.

‘A Bill for an Act to Repeal the Federal Inland Revenue Service (Establishment) Act, No. 13, 2007 and enact the Nigeria Revenue Service (Establishment) Act to Establish the Nigeria Revenue Service, charged with powers of assessment, collection of, and accounting for revenue accruable to the Government of the Federation, and for related Matters, 2024.

‘A Bill for an Act to Provide for the assessment, collection of, and accounting for revenue accruing to the Federation, Federal, States and Local Government; prescribe the powers and funtions of tax authorities, and for related matters, 2024.

‘A Bill for an Act to Repeal certain Acts on taxation and consolidate the l;egal frameworks relating to taxation and enact the Nigeria Tax Act to provide for taxation of income, transactions and instruments, and for related matters.

The bills aim to reform the nation’s tax system, but have faced opposition, particularly due to concerns about the proposed value-added tax (VAT) derivation formula, which critics argue could disproportionately affect northern states.

Northern Governors had strongly opposed the bills, with Borno State Governor warning that they could “crumble the economy of the North.” In response, the National Economic Council (NEC), chaired by Vice President Kashim Shettima, recommended the withdrawal of the bills for further consultations.

Oyo State Governor Seyi Makinde, speaking on behalf of the NEC, had emphasized the need for broader consensus, noting that certain sections of the country found aspects of the bills unacceptable.

Following the controversy, the Senate invited the President’s Economic Team, led by Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, and Zacchaeus Adedeji, Chairman of the Federal Inland Revenue Service, to clarify the bills. Despite their explanations, concerns persisted, prompting the Senate to call for further dialogue.

Deputy Senate President Barau emphasized the Senate’s role as a stabilizing force, stating, “We have decided to set aside politics, ethnicity, and regionalism to resolve the issues surrounding the tax reform bills. In collaboration with the Executive, we will establish a forum to identify and address contentious areas to ensure national unity.”

Barau added that the Attorney General of the Federation would be involved in the discussions to resolve legal disputes surrounding the bills.

The special committee, comprising Senate leadership and key members such as Adamu Aliero, Orji Kalu, Seriake Dickson, and Sani Musa, is scheduled to meet with the Attorney General on Thursday to address the issues.

The Senate reaffirmed its commitment to supporting President Bola Tinubu’s economic reforms while ensuring that no new policies exacerbate the country’s current economic challenges.

-

Crime1 year ago

Crime1 year agoPolice nabs Killer of Varsity Lecturer in Niger

-

News11 months ago

News11 months agoFCT-IRS tells socialite Aisha Achimugu not to forget to file her annual returns

-

Appointment1 year ago

Appointment1 year agoTinubu names El-Rufai, Tope Fasua, others in New appointments

-

News From Kogi1 year ago

News From Kogi1 year agoINEC cancells election in 67 polling units in Ogori-Magongo in Kogi

-

News From Kogi1 year ago

News From Kogi1 year agoEchocho Challenges Tribunal Judgment ordering rerun in 94 polling units

-

News1 year ago

News1 year agoIPOB: Simon Ekpa gives reason for seperatists clamour for Biafra

-

Metro9 months ago

Metro9 months ago‘Listing Simon Ekpa among wanted persons by Nigeria military is rascality, intimidation’

-

News11 months ago

News11 months agoKingmakers of Igu/ Koton-Karfe dare Bello, urge him to reverse deposition of Ohimege-Igu